The Emerging Themes Unit researches on various interdisciplinary and cross-cutting issues relevant to policy and sustainable development. The Unit provides sound policy analysis and research in areas such as Climate Change, Energy, Environment, and Sustainable Development.

The Human Development Unit researches in areas of poverty, education, health, labour markets and other social sectors. The unit provides a resource base on objectively researched policy issues in the social sector in Zambia, and to build capacity in social policy analysis, especially in Government and the private sector.

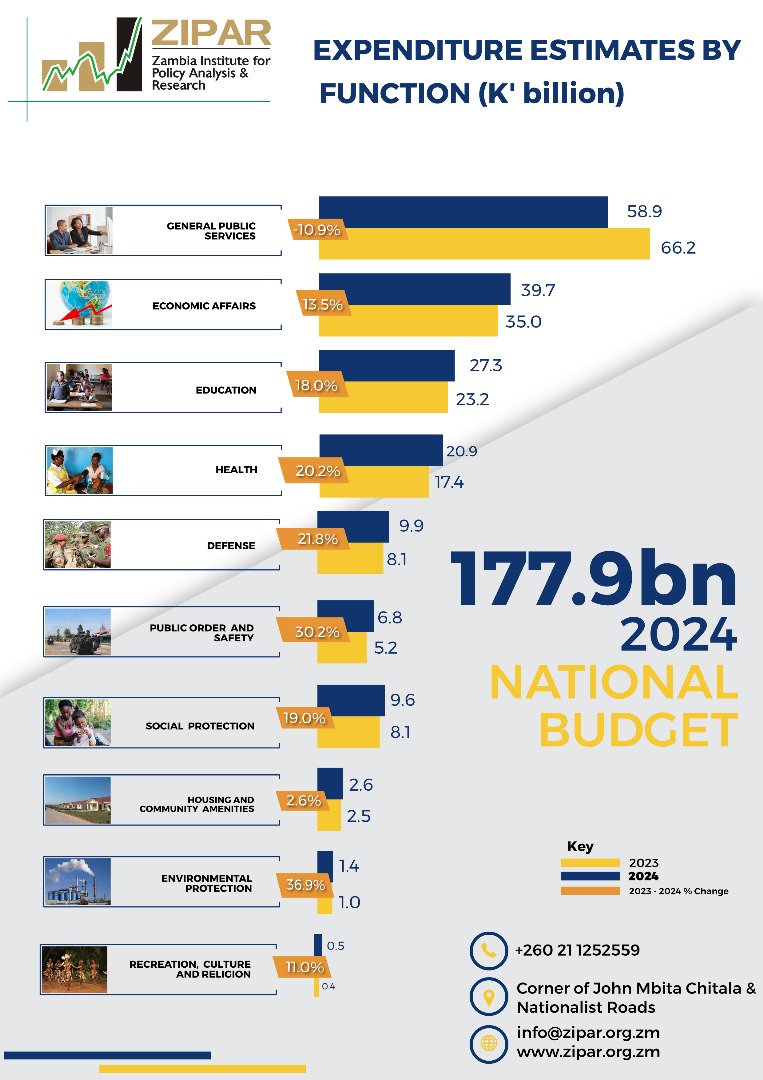

The Public Finance Unit’s overall goal is to improve public policy for growth through policy analysis and research. It focusses on the analysis of public expenditure management, domestic and public external debt, and tax policy.

The overall goal of the Macroeconomics Unit is to improve public policy for growth, equity and poverty reduction through macroeconomic policy analysis and research. It focuses on the analysis of pertinent macroeconomic policy issues such as interest rates, inflation, and exchange rate movements; domestic and external public debt.

The Trade and Investment Unit researches domestic and international trade policy issues. The main objective of the unit is to strengthen Zambia’s capacity in identifying suitable domestic trade reforms. The unit further supports the development of appropriate investment policies while encouraging regional cooperation and international trade policy dialogue.

The Transport and Infrastructure Development Unit focuses on issues relating to the development and provision of physical infrastructure and transport services. The sub-sectors the unit focuses on include: Transportation, information and communications technology, solid waste management, construction, housing and amenities, water and energy infrastructure.

Latest News

Energy Democracy – Visit to Chunga Camp Mini-Grid

April 15, 2024The IMF Country Representative meets ZIPAR

April 9, 2024Greening the Recovery in Zambia

October 24, 2023Latest Articles

Events Calendar

Events for April

1

Events for April

2

Events for April

3

Events for April

4

Events for April

5

Events for April

6

Events for April

7

Events for April

8

Events for April

9

Events for April

10

Events for April

11

Events for April

12

Events for April

13

Events for April

14

Events for April

15

Events for April

16

Events for April

17

Events for April

18

Events for April

19

Events for April

20

Events for April

21

Events for April

22

Events for April

23

Events for April

24

Events for April

25

Events for April

26

Events for April

27

Events for April

28

Events for April

29

Events for April

30

Facebook Feed

Our Contributions

Investor Perception Index: Foreign Investors Perspective on the Investment and Doing Business Environment in Zambia

Publications

- Budget Analysis

- Policy Briefs

- Working Papers

- Parliamentary Submissions

- Reports

- Miscellaneous

- Budget Analysis

Budget Analysis

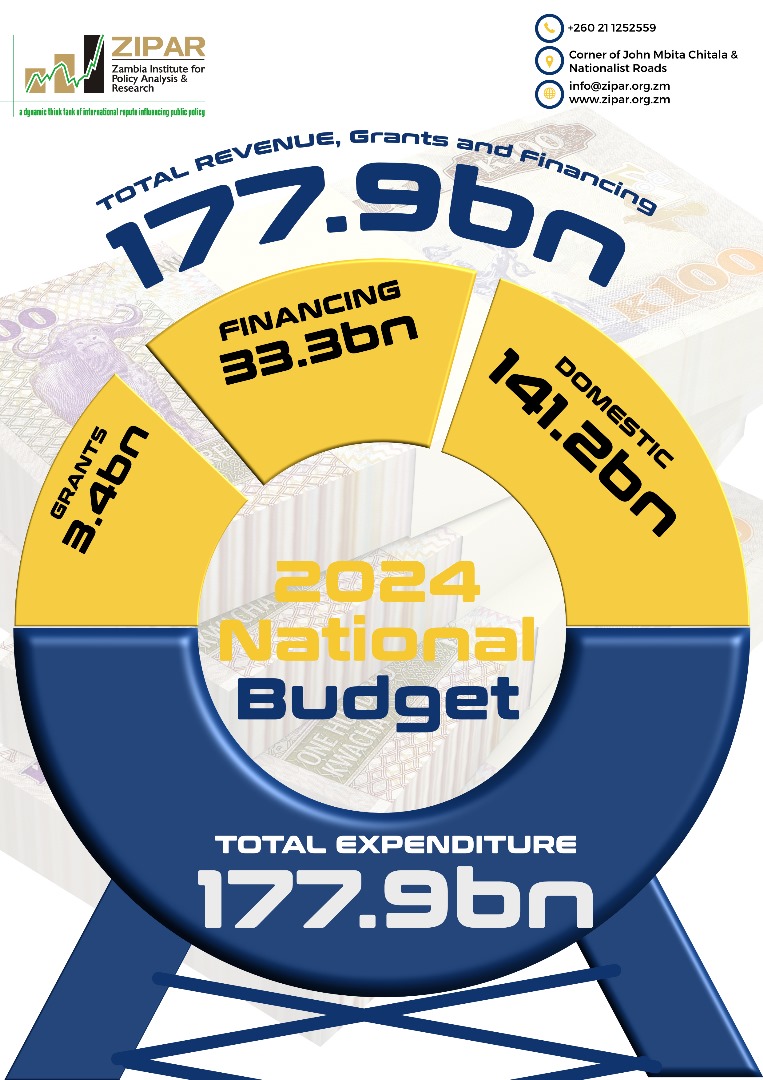

2024 Budget Analysis 2024 final web2

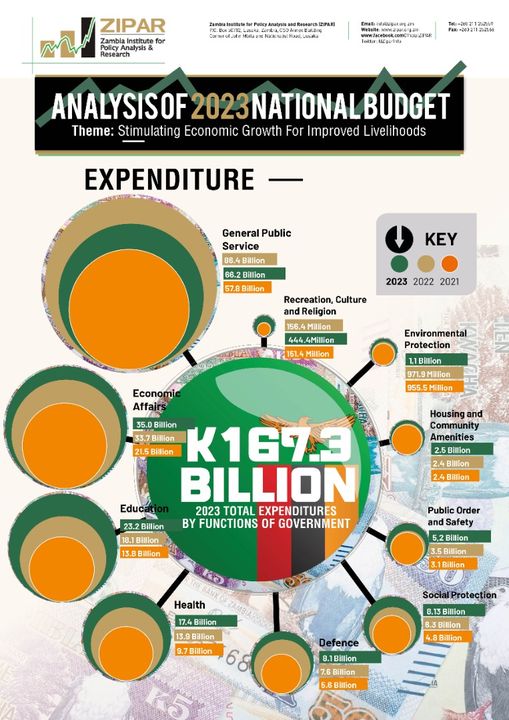

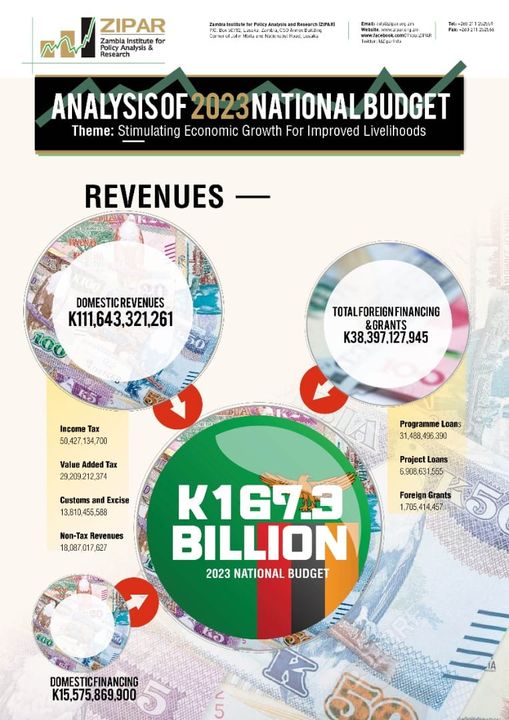

Analysis of the 2023 National Budget (2)

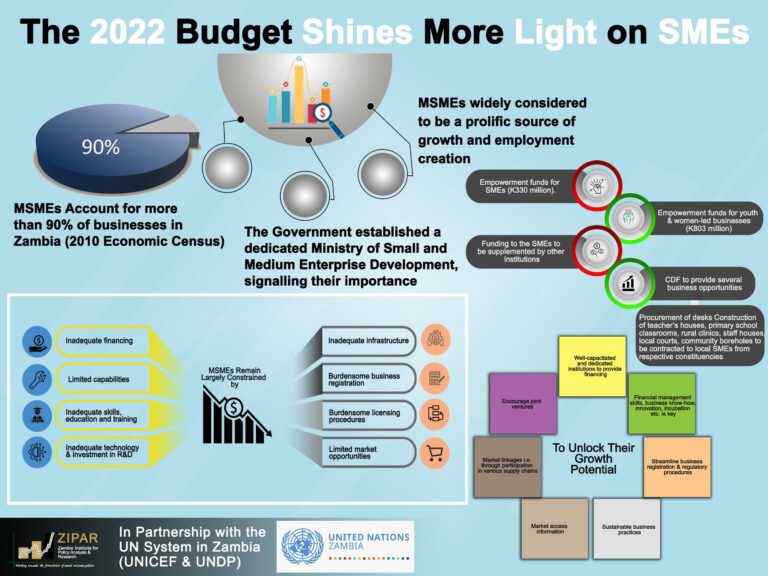

Analysis of 2022 National Budget (2)

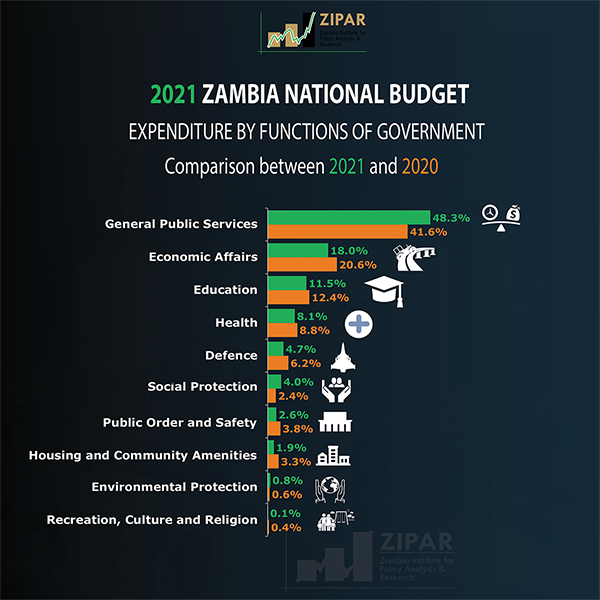

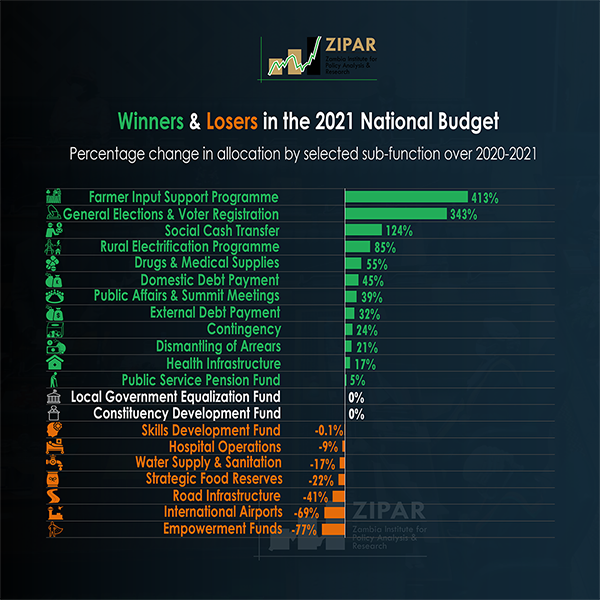

ZIPAR Review of 2021 Budget (2)

Nurturing the seeds of Growth (1)

TAKING THE ROAD LESS TRAVELLED 2019 Budget Analysis (1)

Debt Servicing & the Delivery of Social Services (1)

- Policy Briefs

Policy Briefs

Assessing-impact-free-education-Zambia

The Sales Tax Proposal (1)

State of Financial Cooperatives in Zambia (1)

Who Are the Middle Class in Zambia (1)

Second Hand Motor Vehicles Imports (2)

Making Every Kilometre Count (1)

Financial Cooperatives in Zambia_Compressed

Eurobonds Repayment - Limiting the Risk of Default (1)

Economic Distress and Inevitability of Economic Recovery Programme_Compressed

- Working Papers

Working Papers

wp2021-164-towards-greater-poverty-reduction-Zambia (2)

UCL_GreeningtheRecoveryZambia_Final (1)

Towards An Inflation Targeting Regime in Zambia (1)

Toward Stability and Growth (1)

Switching Costs Relationship (2)

Second Hand Motor Vehicles Imports (2)

Possible Pathways for Zambia to IMF (1)

Mathematical Road Distance Optimisation for the Core Road Network (1)

Leveraging the BRI for Africa’s Industrialisation (1)

- Parliamentary Submissions

Parliamentary Submissions

Zambia Institute for Tourism and Hospitality Studies Amendment Bill_ZIPAR

ZIPAR submission on ZDA_Trade and Investment Bill

ZIPAR Submission on Skills and Career Development in Schools FINAL

ZIPAR Analysis of the 8NDP 2023

Youth Development Fund_National Assembly

The Teaching of Computer Studies and a Review of the Quality of Higher Education in Zambia

The Rural Electrification (Amendment) Bill N.A.B 20 of 2021.

Submission on the Effects of Illicit Financial Flows on the Budget and Its Sustainability.

Submission on MSMEs in Zambia

- Strategic Plans

Strategic Plans

2018-2021 Strategic Plan_compressed

- Miscellaneous